The mirage of blue hydrogen is fading

So called “blue hydrogen”, made using fossil fuels and capturing and storing the associated greenhouse gas emissions, has long been touted as less expensive than renewable alternatives and necessary during a transition phase to a low carbon society. IRENA – the International Renewable Energy Agency, predicted earlier this month that a third of all hydrogen or 200 million tonnes used in 2050 will be blue. The EU is similarly anticipating significant use of blue hydrogen in the years to come. While the EU Commission states in its 2020 Hydrogen strategy that “Renewable hydrogen is the most compatible option with the EU’s climate neutrality and zero pollution goal in the long term and the most coherent with an integrated energy system.”, it goes on to state that “In the short and medium term, however, other forms of low-carbon hydrogen are needed, primarily to rapidly reduce emissions from existing hydrogen production…”

It would be a disaster for the climate and a massive failure of energy and industrial policy to use so much fossil fuel-based hydrogen in 2050.

Over the last six months a series of myths about blue hydrogen have been busted. Let’s take stock.

The first myth that has been busted is that blue hydrogen is “clean”.

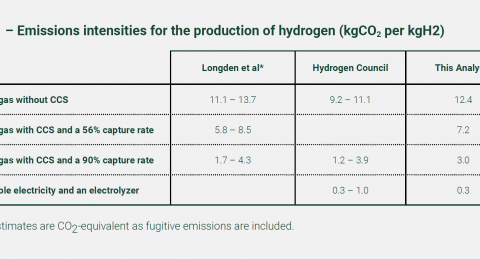

Blue hydrogen requires the production of grey hydrogen from natural gas. Grey hydrogen produces large greenhouse gas emissions: between 11.1 – 13.7 kg of CO2 equivalent for every 1 kilogram of hydrogen. The clean or blue label rests on the viability of carbon capture and storage technology at scale and addressing fugitive emissions of methane associated with the extraction and transportation of natural gas.

In 2021, researchers Robert W. Howarth and Mark Z Jacobson calculated that: “Far from being low carbon, greenhouse gas emissions from the production of blue hydrogen are quite high, particularly due to the release of fugitive methane”. These fugitive emissions occur before any carbon capture and storage. Even proponents of blue hydrogen argue that it requires a “very high” carbon capture rate. The suggestion is usually that well over 90% of the carbon emissions should be captured and that any methane leakages should be very small.

Such production of blue hydrogen does not exist at scale today. As the magazine Recharge wrote this month: “It is worth pointing out that only four blue hydrogen projects are currently in operation worldwide, all with very low carbon capture rates, with the highest being the 43% at Shell’s Quest facility in Alberta, Canada, and the lowest being the 29% at ammonia producer Nutrien’s plant in the same province”.

As noted in our launch report, citing recent research from the Australian National University (Longden et al 2021) with a 56% capture rate, the emissions from blue hydrogen are still large at 5.8 – 8.5kg per kg hydrogen. With a 90% capture rate, emissions are still substantial (1.7 – 4.3kg). None of these outcomes is clean or sustainable. Green hydrogen has an emissions profile that is close to zero.

As IRENA note: “If new [blue] plants and assets are built to operate on fossil fuels, they will lock in billions of tonnes of greenhouse gas emissions and risk becoming stranded in the journey to net zero. With few investment cycles left before 2050, it will be critical to make these plants future-proof”.

It is becoming increasingly clear that it is not logical or necessary to “future-proof” the hydrogen industry based on unproven CCS technology. As the energy commentator Michael Liebreich tweeted last year “…blue hydrogen with 90% capture is incompatible with net zero. There will simply not be enough offsets…”. Not to mention that relying on offsets is a not a sound approach to begin with.

The only clean option is green hydrogen, with close to zero emissions.

The second myth that has been busted is that blue hydrogen can act as a transition fuel, before green hydrogen becomes available in large quantities.

As noted above, blue hydrogen is not produced in significant quantities today and is not ready to be scaled up to support the energy transition. It can only be done at large scale, which means that it takes a long time to get projects off the ground. As BloombergNEF have noted:

“With blue hydrogen, it is go big or go home. A typical project costs $500 million to build, and there is not much scope to go smaller – the technology only works at large scale. That’s an awful lot of risk to bear on a single project. Most companies won’t have the appetite for it. Another problem is that demand for clean hydrogen at those scales doesn’t exist yet, and isn’t likely before 2030, by which time green will be cheaper. So the large-scale of blue hydrogen is actually a curse.”

The article goes on to conclude that “Only a decade ago, carbon capture and storage was hailed as both the cheapest option for cleaner electricity generation and the only new technology that was capable of delivering at scale.” Instead, it is increasingly likely that large quantities of green hydrogen are likely to be available before large quantities of blue”. Green will displace grey. Blue is not needed as a stepping-stone.

The third myth about blue hydrogen that has been busted is that it is cheaper than green hydrogen.

We should start by acknowledging that the cost of grey hydrogen (and blue hydrogen by extension) is lowered by massive subsidies that put renewable technologies at a huge disadvantage. The IMF has calculated that the fossil fuel industry receives a stunning $5.2 trillion in subsidies annually. Blue hydrogen projects require additional support beyond these subsidies. So far, all carbon capture and storage projects have required significant public funding and/or tax incentives. Fortunately, a growing number of countries and regions are charging for carbon emissions and are moving away from subsidizing the fossil fuel industry.

Even setting subsidies aside, it is clear that green hydrogen is getting cheaper faster than expected and is already or will soon out compete blue. Green hydrogen is benefitting from the rapidly falling cost of renewable energy (which accounts for ~70% of the cost of producing green hydrogen) and greater efficiency and lower costs of electrolysers. The Rocky Mountain Institute, which has long been studying hydrogen markets, stated in October 2021 that recent developments “..will also help drive green hydrogen costs below $2 per kilogram, making it competitive with blue and in some cases grey hydrogen,..”. Since then, natural gas prices have risen further, making green hydrogen more competitive.

The last myth is that blue is essential because scaling up green hydrogen is impossible.

If challenged on emissions, technical viability and costs, blue hydrogen advocates

have argued that blue hydrogen is essential because there simply isn't enough renewable energy capacity to support a rapid acceleration of green hydrogen production. Granted, it is difficult to forecast how quickly and at what prices we can scale up the production of renewable energy and electrolysis equipment. But we know that the cost curve of solar and wind power has fallen dramatically. “Solar installs globally could double or treble again within three years”, according to Tim Buckley, writing in Asian Power January 2022.

We also know that the prices quoted by electrolysis manufacturers have fallen dramatically too, even before significant mass production of electrolysis equipment has commenced. Buckley again: “The move from tiny batch manufacturing to gigawatt scale manufacturing is moving at lightspeed…Nel moved from 40 megawatts to 500 megawatts in 2021; ITM Power from 100 MW to 1000 MW in 2021.”

Developments in terms of costs and efficiency of both solar and wind, as well as electrolysis equipment appears to be akin to that of computers, with George Moore’s law from 1965 predicting that the capacity of computers (number of transistors in a microchip) would double every two years. This has largely turned out to be true. The combination of technological advances and economies of scale is likely to result in falling costs for decades to come, requiring a new law to describe the combined effect of greater efficiency at every stage of the green hydrogen value chain.

The BloombergNEF Green Scenario estimates that 800 mt of green hydrogen will be demanded in 2050. This would require about 37 500 TWh of power or about 10 000 GW of installed renewable generating capacity. Forecasts based on installed renewable generating capacity need to be treated with some caution, because the capacity factor (energy output) varies widely for different renewable energy sources. This is daunting, but not impossible. According to the IEA, the world added 290 GW of new renewable capacity in 2021. Globally, renewable electricity capacity is forecast to increase by over 60% between 2020 and 2026, reaching more than 4 800 GW. This is equivalent to the current global power capacity of fossil fuels and nuclear combined. China alone is aiming to achieve 1 200 GW of total wind and solar PV capacity by 2030 and is on track to reach this target four years early.

Progress achieved in recent years is encouraging. Moreover, a strong market signal from green hydrogen consumers - especially from industries that switch from using grey to green hydrogen - is key to incentivising energy companies to further accelerate their investments in renewable energy.

It is time to acknowledge that we don’t make much blue hydrogen today and we will not make it at scale with high capture rates any time soon. As we get closer to the destination, the mirage of blue hydrogen disappears. As the chairman of GH2 Malcolm Turnbull writes on blue: “It has failed, and not for want of trying. Its only value is as a means for delaying the necessary transition away from fossil fuels.” It is time to stop the gamble on blue hydrogen undermining and delaying investments in renewable energy and green hydrogen.