Championing Green Hydrogen at COP30 in Belém

The move away from the old energy system built on fossil fuels to one driven by renewables is gathering pace.

This is the message we are taking to COP30 in Brazil this week with our colleagues in the Global Renewables Alliance.

The rise of ‘electrotech’ based on renewable electricity such as green hydrogen will dismantle fossil fuel dependence, improve energy security and decarbonise the countries which seize this huge opportunity.

The good news is that 75% of the global energy system can be directly electrified with renewables using existing technologies. Independent analysis from the IEA, IRENA, BloombergNEF, Lazard all find that renewables are now the cheapest way to produce power in most places around the world. The cost of solar power has fallen ~90% since 2010. Battery costs have fallen ~80%. And the costs of renewable will continue to fall. For those sectors like iron and steel; chemicals and fertilizers; shipping and aviation which can’t be fully electrified directly with renewable energy, green hydrogen can ensure renewables reaches them too.

These are the sectors where we really need to see progress, and where healthy competition will drive down costs and increase scale. China is moving at breakneck speed when it comes to green hydrogen and Europe is doing its best to keep up. The European Commission’s Sustainable Transport Investment Plan published this week doubles down on efforts to reach its targets and notes “a sustained scaling up of current market volumes, including for e-fuels, is necessary to meet these targets, which is vital for Europe’s competitiveness and global leadership.” The plan, which is expected to mobilise at least €2.9bn until the end of 2027 for renewable and low-carbon fuels, includes: a €300 million auction for projects with aviation and maritime offtakers; the allocation of €446 million for 4 eSAF and 5 sustainable maritime fuel projects; and the launch of an eSAF Early Movers Coalition pilot project worth €500m by the end of 2025.

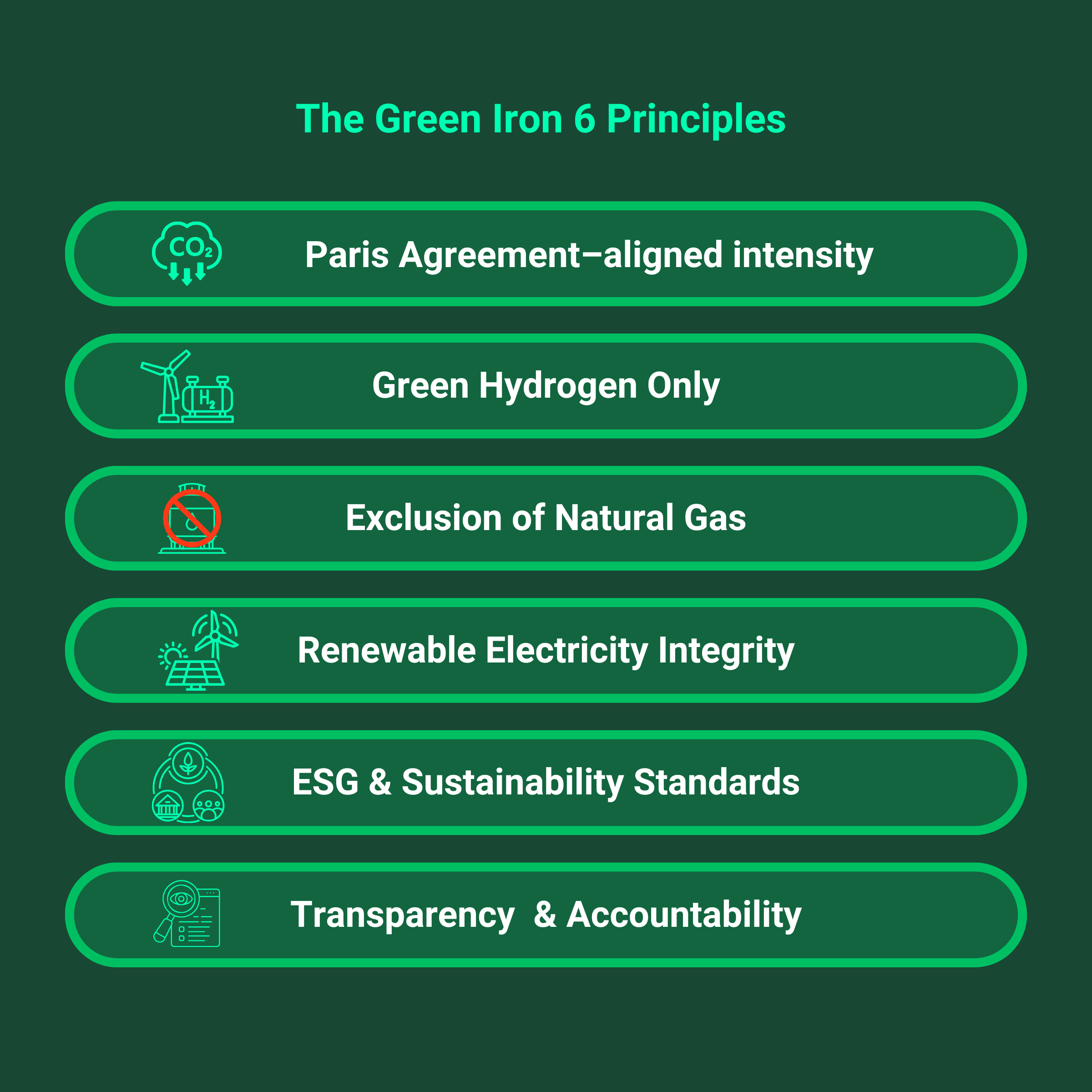

The battle is also on for scaling and driving down the cost of green iron using green hydrogen instead of coal or natural gas. Australia has great fundamentals, and the MENA region is a real contender too. Investors and manufacturers are ready to pay a premium for verified low-carbon materials. But the development of these markets depends on clarity and credibility. Next week GH2 is launching the “Green Iron Principles”. The Principles establish that green iron is iron produced with renewable energy and green hydrogen. They exclude the use of coal and natural gas. And, crucially, they ensure the green iron is produced using high environmental, social and governance standards. As GH2 Chair Jonas Moberg commented: “For the first time, we have a clear, science-based definition of green iron — one that aligns with the Paris Agreement and excludes fossil fuels from every part of the process. This is about setting a standard the world can trust.”

Next week at COP we will also be closely monitoring support for the Brazilian government’s Belém 4x Pledge on Sustainable Fuels. The text very helpfully reiterates the language of moving away from fossil fuels. It seeks to expand sustainable fuels use globally by at least four times by 2035 and focuses on both biofuels and “renewable, clean/zero emission and low carbon hydrogen and its derivatives”. The pledge calls for “consistency in carbon accounting that will enable sustainable fuels’ scalability, affordability, fair competition and rapid deployment” which aligns with the ISO’s ambition for the ISO 19870 methodology for determining the greenhouse gas emissions associated with the hydrogen supply chain. Methodological rigour and alignment is welcome, but more attention is needed on what pathways are genuinely sustainable and net zero aligned. As T&E and others have noted, unsustainable biofuels can drive deforestation, land-use change, and competition with food production, leading to higher greenhouse gas emissions and social and environmental harm. In contrast, green hydrogen production has close to zero emissions, carries much less risk, and can be deployed at much greater scale.

Some have criticized and chosen not to attend COP30 this year. We are not in that camp. While we are not expecting any breakthrough agreement at this year’s gathering, it is a crucial moment to progress implementation of climate goals and for leading countries to inspire progress across the world at a time when multilateralism has taken a battering such as the recent delay to the International Maritime Organisation Net Zero Framework which we must urgently get back on track.

Please look at our program for COP30 below and do come and see us if you will be in Belem!

Joe Williams,

CEO, GH2

During COP30, GH2 will host two sessions among many others at the Global Renewables Hub and engage in a number of events with partners advancing the clean energy transition.

See GH2’s full schedule: Green Hydrogen at COP30 | Green Hydrogen Organisation

The Molecule That Takes the Renewable Electrons Further

📅 Friday, 14 November 2025 | 13:30 – 14:30 BRT

📍 Global Renewables Hub, PV-C110, Blue Zone

Moderated by Jonas Moberg (Chair, GH2) with opening remarks from Lord Adair Turner (Chair, Energy Transitions Commission)

Renewable electrification is advancing, yet deployment of green hydrogen, ammonia and e-fuels remains limited. This session will examine the policy, demand and investment conditions required to scale the production and use of green molecules for fertilisers, shipping and steel, and will include GH2’s response to the Belém 4x Pledge on Sustainable Fuels.

Financing the Green Industrial Transition: Building Shared Infrastructure and Lowering the Cost of Capital

📅 Saturday, 15 November 2025 | 16:30 – 17:30 BRT

📍 Global Renewables Hub, PV-C110, Blue Zone

In partnership with the Industrial Transition Accelerator and Climate Analytics

Moderated by Joe Williams (CEO, GH2)

Delivering Real Zero industrial systems requires finance that makes clean industry investable in all regions. This session will focus on reducing the cost of capital and enabling shared infrastructure for renewables-based industrial projects. Multilateral development banks, donors and developers will highlight successful cases and regional cooperation models that can accelerate bankable projects.