European security must be built on renewables and green hydrogen

As leaders gather for the 62nd Munich Security Conference this weekend, Europe is redefining its security in a more fragmented world.

The war in Ukraine exposed a structural weakness in Europe’s energy system: heavy reliance on external fossil fuel supplies. In 2021, 40% of EU gas imports came from Russia. When those flows were disrupted, gas prices hit record highs and triggered an economic shock. Energy quickly became political leverage, with industry facing higher costs and production cuts. As Bruce Douglas, CEO of the Global Renewables Alliance which GH2 co-founded, wrote in his op-ed this week, renewables should form the foundation of a more secure system. The economics support that case. According to IRENA, 91% of newly built renewable power globally is now cheaper than fossil fuel alternatives, with wind and solar often the lowest-cost sources of new electricity.

Policy is also beginning to align. In Europe, North Sea countries just committed under the Hamburg Declaration to expand offshore wind capacity to 100GW and strengthen cross-border infrastructure, including on hydrogen. UK energy secretary Ed Miliband and EU energy commissioner Dan Jørgensen were clear that these efforts were put in place to escape the roller coaster of international fossil fuel markets.

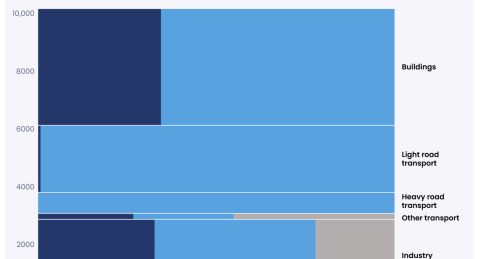

As Ember’s analysis shows (Fig 1), most EU energy demand is already electrified or ready to electrify directly.

Yet sectors such as steel, fertilisers, chemicals and shipping require a different solution. That is where green hydrogen becomes central – extending renewables into sectors critical to Europe’s economic stability.

This is where Europe needs to double down, not least in the face of domestic green hydrogen markets which are ramping up in China and India. This week India’s most recent auctions resulted in a winning bid of just over USD 3 per kg green hydrogen which is incredibly competitive.

Europe must first follow through on its green hydrogen targets under the Renewable Energy Directive, FuelEU Maritime and ReFuelEU Aviation.

All eyes will be on the upcoming EU Industrial Accelerator Act and how it helps to simulate lead markets for sectors like steel and fertlisers through quotas, procurement requirements and support schemes. The EU’s world leading Emission Trading System and Carbon Border Adjustment Mechanism must also be maintained to promote a level playing field.

Finally, the EU should strongly support the adoption of the International Maritime Organisation Net-Zero Framework this year to give the industry the certainty it requires and stimulate green hydrogen based fuels both domestically and around the world.

Joe Williams,

CEO, GH2

Recent green hydrogen developments worldwide:

- Morocco signed preliminary land agreements to develop seven green hydrogen projects in Laayoune, Boujdour and Dakhla, targeting 20 GW of renewables and 800,000 tonnes of derivatives. The selected developers include ORNX (Ortus Energy, ACCIONA and Nordex), TAQA Morocco with Moeve, ACWA Power, Nareva, and a consortium of China Three Gorges and United Energy Group. The projects are some of the first to advance under the “Morocco Offer”, from 40 proposals submitted by investors across 17 countries.

- On 10 February, Egypt and the EU signed a EUR 125 million grant agreement, managed by the European Investment Bank (EIB), to advance sustainable energy cooperation. The package includes EUR 35 million for Scatec’s green ammonia project in Ain Sokhna and EUR 90 million to support grid modernisation and expansion by 2030.

- Six leading European electrolyser manufacturers (ITM Power, John Cockerill, Nel, Sunfire, Thyssenkrupp Nucera, and Topsoe) formed the "Electrolysers for Europe" (E4E) coalition to accelerate the deployment of green hydrogen, target 10 GW annual manufacturing capacity, and demand "Made in Europe" support.

- Dutch state-owned energy infrastructure company Gasunie filled the first 32-kilometre section of its national hydrogen pipeline network. The pipeline is part of a planned 1,200-kilometre grid linking the major industrial ports of Zeeland, Rotterdam, Amsterdam, and the northern Netherlands, with future connections to Germany.

MENA green iron opportunity: Decarbonising the global steel industry

Green iron offers a credible pathway to decarbonise one of the world’s most emissions-intensive industries. The MENA region - in particular Oman, Saudi Arabia and Egypt - is uniquely positioned to become a first mover, combining exceptional renewable energy resources, low-cost green hydrogen potential and existing DRI infrastructure. GH2’s new policy brief takes stock of the current green iron landscape in MENA by analysing 22 announced projects and sets out key recommendations for scaling green iron production.

Integrated water resource management for green iron production

As projects move toward final investment decisions, water governance is becoming decisive for bankability, social licence and long-term credibility. GH2’s new guidance note reviews four established frameworks from the IHA, ResponsibleSteel, ICMM and the Green Hydrogen Standard, and identifies where stronger integration across the value chain is required.