Spotlight on Indonesia: putting the building blocks in place to support green hydrogen

We begin 2025 with a dive into the state of the renewable energy and green hydrogen sector in Indonesia. For the world’s fourth most populated nation, seventh largest economy, twelfth largest energy consumer and ninth largest emitter of CO2, the role of the decarbonisation is of global importance.

Soon after President Prabowo Subianto’s inauguration in October 2024, he used November’s G20 Summit in Brazil to set out his country’s green energy vision, plans for net zero by 2050, as well as a commitment to replace coal in the power sector and to develop more than 75 gigawatts of renewable energy by 2040.

Minister Bahlil Lahadalia was appointed by President Prabowo in January 2025 to lead the government’s task force on industrial development and energy security, reflecting a strong desire by the current government to ensure that higher values are extracted from the nation’s significant production of commodities. Building on the decision in 2020 to ban the export of nickel ore, the government is now determined to go further in ensuring that it reaps the benefits from its vast resources. The implementation of the National Hydrogen Strategy adopted in 2023 should be seen in the context government priority of in-country value addition.

Despite its incredible solar and geothermal potential, with year-round sunshine and the world’s largest geothermal potential (27.79 GW), Indonesia is struggling to shift towards renewable energy, with renewables only making up 13% of energy consumption in 2023 and the country likely to reduce its renewable energy target of 23% by 2025 to 17-19%. Unfortunately, investments in renewable energy have been falling in recent years and GH2’s friend Fabby Tumiwa, the executive director of the Institute for Essential Services and Reform, concluded that in 2023 investment in renewable energy was the lowest since 2017.

Despite its US$20 billion Just Energy Transition Partnership (JETP), the largest energy transition financing package in the world, little of the funding has been disbursed and there are only plans to retire 1.7 gigawatts of coal power plants, with over 20 gigawatts of coal expansion still in the pipeline.

Developing the green hydrogen sector should be a cornerstone of the new government’s focus on improving national benefits from its resources. Most of Indonesia’s hydrogen demand – about 1.75 million tonnes a year - comes from fertilisers and petrochemicals. Demand is expected to skyrocket to 9 million tonnes by 2030. This growth could create a large number of jobs, not just in the renewable energy and green hydrogen industry, but right across sectors benefitting from cheap renewable energy.

Green hydrogen can also play a key role as a storage medium for the increases in renewable energy deployment which are required, and as coal is phased out green hydrogen can help balance the grid.

The Ministry of Energy and Mineral Resources (MEMR) is ramping up its efforts to develop government regulation (PP) for the hydrogen industry, along with a roadmap and action plan for low-carbon hydrogen and ammonia, by putting together a special hydrogen team within the ministry and assigning a senior leader to oversee the process. Yuliot Tanjung, Vice Minister of MEMR, personally joined the review of the roadmap and action plan, emphasizing its alignment with national priorities outlined by President Prabowo. “The transition from fossil fuels to more environmentally friendly renewable energy sources continues to be a priority, including through the development of hydrogen and ammonia,” Yuliot stated.

With support from the Green Hydrogen Organisation, the MEMR is currently developing a national standard for green and low-carbon hydrogen. A multi-ministerial technical committee has been assembled and the plan is to finalise the draft standard by mid-February 2025.

The government’s efforts to implement the Hydrogen Strategy also include the development of a low-carbon hydrogen business classification code (KBLI). The government uses these codes to issue tax identification numbers (NPWP), trade licenses (SIUP), and other important legal documents. It’s crucial for any private developers to choose the right code. Getting it wrong could lead to sanctions, from temporary suspensions to losing the right to operate. If a company is considering registering its business after Q3 this year, it is likely that it will need the new KBLI codes, which will be approved and legalised by September 2025.

To support the growth of the green hydrogen market in Asia Pacific, Breakthrough Energy and the Green Hydrogen Organisation (GH2) have established the APAC Green Hydrogen Alliance (APAC Alliance) which brings together government, industry, finance and civil society to increase regional collaboration on enabling policy measures and financing incentives; accelerating sustainable production, use and trade of green hydrogen; and to catalyse financing for green hydrogen projects. Indonesia's hydrogen sector is at the heart of this initiative. At the APAC Alliance most recent meeting, in December 2024, PLN and HDF Energy highlighted Indonesia’s progress to address challenges such as infrastructure readiness and market adoption in the green hydrogen sector.

Investment in the green hydrogen economy in Indonesia still remains relatively limited, even if there is a large group of companies developing projects. These include Sembcorp’s green hydrogen hub, linking Sumatra, the Riau Islands, and Singapore; Kamojang Green Hydrogen Plant, the first geothermal-based green hydrogen in the Southeast Asia led by PLN as well as a partnership between Hyundai and Samsung on a USD 1.2 billion project to produce green hydrogen in Sarulla block, North Sumatra.

In collaboration with leading law firms in Jakarta, A&O Shearman, Baker McKenzie, Herbert Smith Freehills and White & Chase, we are developing comprehensive legislative guides to support government and industry stakeholders in navigating critical aspects of green hydrogen projects. These guides will provide clarity and direction on:

- Funding mechanisms, offtake agreements, and project financing to facilitate investment and ensure project bankability.

- Certification and categorization of hydrogen, including specific criteria based on emission levels, energy sources, and production processes.

- Licensing frameworks, infrastructure support, and public access, addressing land use, stakeholder consultation, and the development of supporting facilities.

- Pricing structures, subsidies, and government incentives to promote market adoption and encourage the growth of a robust hydrogen economy.

These resources aim to streamline project implementation and foster the growth of Indonesia’s green hydrogen sector.

Discover more about Indonesia on GH2’s country portal.

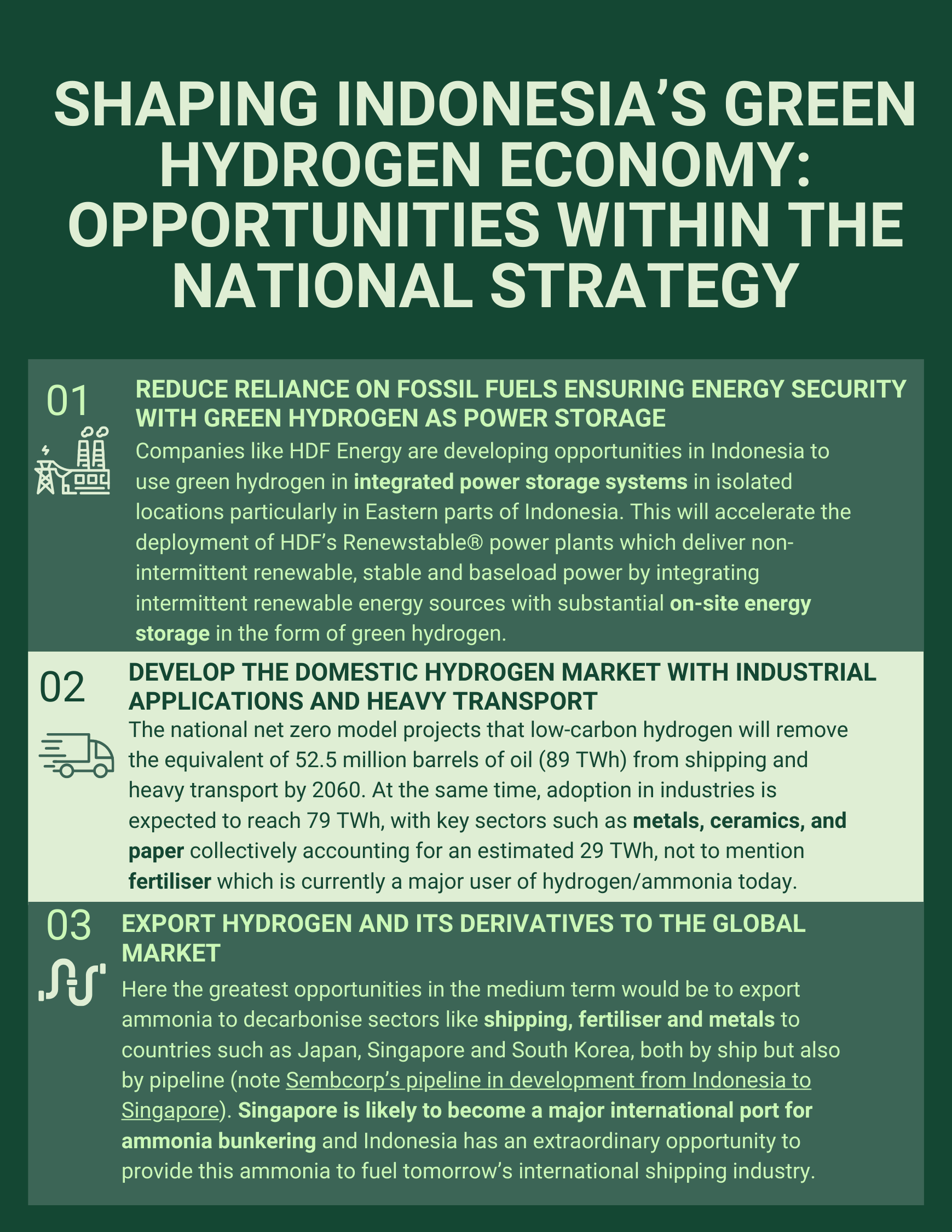

Focusing on the potential shape of Indonesia's green hydrogen sector, the starting point lies in its renewable energy potential. The National Strategy outlines three pillars, each presenting unique opportunities that we explore below: