What we learnt this summer about green hydrogen and ammonia prices and production

Green hydrogen and ammonia are starting to reach markets at lower prices, including less than $600/tonne of ammonia in the case of India. Without support to lower capital costs, producers outside India and China will struggle to be competitive. Following the cancellation of several of the winning bids of the European Hydrogen Bank, Europe needs to go back to the drawing board on how to bring in the renewable hydrogen it needs. Countries in Africa, Latin America and elsewhere, and their supporters in development banks etc, need to carefully study what is now happening China and India with large scale project coming onstream. Standards and certification also need renewed attention. We are seeing the beginning of the trade of different qualities of green hydrogen and ammonia, with different approaches to defining renewable electricity use and limited attention to other essential sustainability criteria.

As the holiday season comes to an end here in Europe, here’s our quick take on what has happened in recent weeks.

1. With four of the winning projects in the European Hydrogen Bank auctions having been withdrawn, this mechanism needs to be reconsidered.

What appears to happen is that project developers keen on the involvement of the EU Commission outbid each other to such low levels that the support is spread too thinly on projects that are too far away from financial viability. The international pillar of the Bank, launched in May 2023, is still under development. Many are now questioning whether the European Hydrogen Bank is fit for purpose. Jonas was quoted in Hydrogen Insight last week saying “These auctions show that the relatively limited support provided through the European Hydrogen Bank is not sufficient. In Europe we must urgently return to the drawing board and find better ways to kick start the green hydrogen industry.”

As William Todt, CEO of Transport and Environment writes: “ The H2 bank was a bold, new instrument when it was launched. Now it must change, or it will become a symbol of failed EU industrial policy”. The Commission clearly needs to refine the formula, and it should be relatively easy to demand a little more from bidders, for example about the expected production costs before and after support from the European Hydrogen Bank and on offtaker pricing expectations, to avoid unrealistic projects bidding for insufficient support. Introducing these changes for the first auction open for projects outside of the EU would be a good start.

While Europe continues to lead the world on carbon pricing and renewable hydrogen ambition, project execution is slow and complex. Barely anyone expects anything close to the European Commission’s ambitious target of 10 million tonnes per annum of domestic production and 10 million tonnes per annum of green hydrogen imports by 2030. Member state transposition of mandated targets in RED III is behind schedule, although it is encouraging that the Commission is increasing its efforts to support member state implementation.

(At GH2, we will in the coming weeks and months work closely with partners in Brussels and elsewhere on how the EU can, and urgently must, continue to tweak the enabling environment for green hydrogen).

2. In China, the National Energy Administration announced the first eight green methanol and green ammonia pilot projects that will be given priority to receive state support subject to them achieving “high and stable” production load by June 2027.

We doubt that anyone has missed that Envision Energy commissioned the first 500MW of a planned 2.5GW green hydrogen and ammonia facility in Chifeng, China. The project is now the largest in the world by installed electrolyser capacity, producing 320 000 tonnes of ammonia per year with exports commencing in Q4 2025. In August, the China Energy Investment Corporation (CEIC), which is 100% owned by the Chinese government, was given approval to begin construction on a 2.2GW green hydrogen-to-ammonia project in Inner Mongolia. While pricing data has not been disclosed, S&P report that Chinese renewable ammonia producers are targeting European markets with sub-$700/tonne free on board offers. The green methanol projects include Shanghai Electric’s 250,000-tonnes-per-year plant in Jilin province.

3. In India, the first auction conducted by the Solar Energy Corporation of India for the procurement of Green Ammonia under the SIGHT Scheme achieved a record low price INR 55.75 per kg (around $640/tonne).

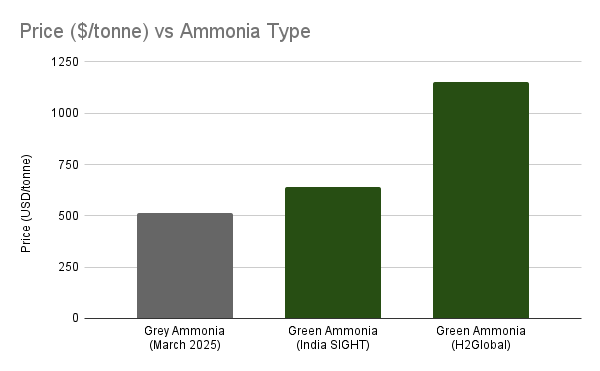

The price, offered by ACME Cleantech Solutions, is substantially lower than the $1,153/tonne observed in the international H2Global auction and contrasts with the reported price of grey ammonia at $515/tonne (as of March 2025), not significantly more expensive than relatively modest carbon emissions charge would imply.

In subsequent rounds, Jakson Green agreed to supply Coromandel International in Andhra Pradesh with 85,000 tonnes of ammonia per annum for 10 years at a price of 50.75 rupees ($583/Tonne) and ACME agreed to supply the same firm with 50,000 tonnes of ammonia per annum for 10 years at a price of 51.89 rupees ($596/Tonne).

4. In Africa, Latin America and elsewhere, lessons needs to be drawn from these developments in China and India.

In addition to the well-known lack of secure customers, the cost of capital for investments in many of these countries needs to come down. The very competitive prices for green ammonia export from China are in part achieved because of state interventions bringing down the costs of capital.

Bilateral and multilateral development banks, export banks and guarantee institutions need to collaborate in new ways to really support renewable energy projects in emerging markets and developing countries.

Even if these governments do not have the financial muscle like that of the Chinese government, there are many things they can do to help projects developers to secure offtake agreements and reach financial investment decisions. For example, in several African countries there is a need for shared infrastructure. It often takes many years of work by consultants, assistance by development partners, to work out what infrastructure is needed, how should be financed and paid for. Hosting governments can and must be must faster in creating the enabling environments, settling on the terms and conditions, for these projects.

GH2 and Nile University, supported by GIZ and partners like the Industrial Transition Accelerator, under the banner of the GH2 International Green Hydrogen Centre of Excellence in Cairo will host the Cairo Regional Forum on Financing Renewables, Green Hydrogen and Green Ammonia on 17-18 September 2025 at Nile University.

5. We are starting to see the emergence of a two-tier market for green hydrogen and ammonia based on what qualifies as renewable electricity use.

One market has “deep green” credentials based on additional, hourly and market matched renewable electricity, for example as required for RFNBO designation in the EU, and another where these criteria are not fully satisfied, as is the case for some of the projects in India.

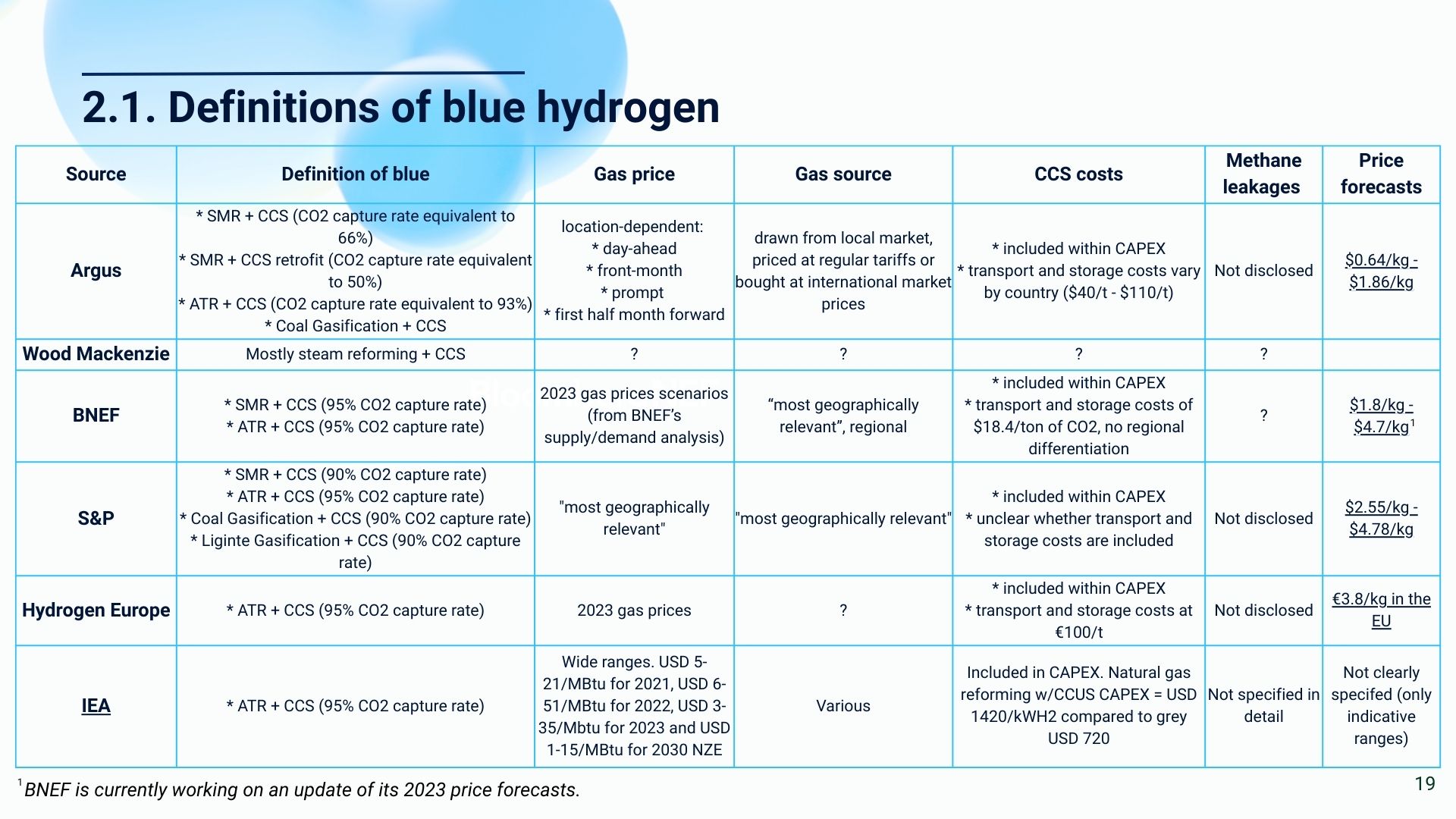

We are a long way from a level playing field where hydrogen production costs can be compared on a like-for-like basis. The “grey price” – which is usually used as a reference – almost always includes a substantial and undisclosed “dirty discount”. In most markets, fossil fuel-based hydrogen and ammonia benefit from substantial direct and indirect subsidies, well-established infrastructure, and no effective carbon pricing. We are a long way from a level playing field where hydrogen production costs can be compared on a like-for-like basis. You can read more about these issues in GH2’s publication: In search of the real price of blue hydrogen.

6. Let us close on a couple of observations about demand. The emerging picture is mixed. The auctions in India have focussed on supplying green ammonia for the fertiliser industry. In China, Envision has reportedly sold part of its offtake to Marubeni. The end use is not specified, but Marubeni has plans to supply Japanese power producers with low-carbon ammonia that will be co-fired with existing fuels including coal to reduce CO2 emissions. Shanghai Electric’s green methanol project is reportedly planning to use the initial batch of green methanol in Shanghai Port as a maritime fuel.

The meeting of the International Maritime Organization in October – which is expected to approve the Net-Zero Framework including a reward for “zero or near zero” (ZNZ) fuels – will be a crucial step in generating more demand for green fuel. GH2 recently published a briefing on the opportunity for Pacific leadership in maritime decarbonisation. Returning to Europe, Wood Mackenzie have noted how, ironically, demand from Europe’s oil refiners could offer a route to scale up green hydrogen. They note that European oil refineries will require at least 500 000 tonnes of green hydrogen to meet the EU rules under RED III.

Our colleague Joe Williams has been in Australia this week focusing on the potential for green iron in Asia Pacific at a workshop convened by the World Economic Forum’s First Movers Coalition and Greenhouse in likely COP31 host city Adelaide. In Australia a lack of green hydrogen export demand has led to a number of high profile project cancellations this year such as the Central Queensland Hydrogen Project. However, Australia’s fundamentals of massive iron ore resources and abundant world class renewables suggest green iron can be the key to underpinning green hydrogen demand in the country if the right financing, policy levers and international partners can be put in place. The hope is that a small number of large projects – including a reconfiguration of the Whyalla steelworks in South Australia towards a green future – could become bankable by the end of next year. The Super Power Institute, co-founded by economist and former Australian ambassador to China Ross Garnaut, estimates that an additional tax credit of just over USD 100 per tonne of iron is what is needed to bridge the funding gap.

Jonas Moberg,

CEO, GH2