Solving Japan and South Korea’s renewable energy conundrum with green hydrogen

While it is right that Japan and South Korea deploy as much domestic renewable energy capacity as possible to green their grids, it is clear that both countries will also need to import large amounts of green hydrogen or green ammonia to decarbonise their significant industrial sectors. Government schemes currently being implemented will be decisive in whether this becomes a reality.

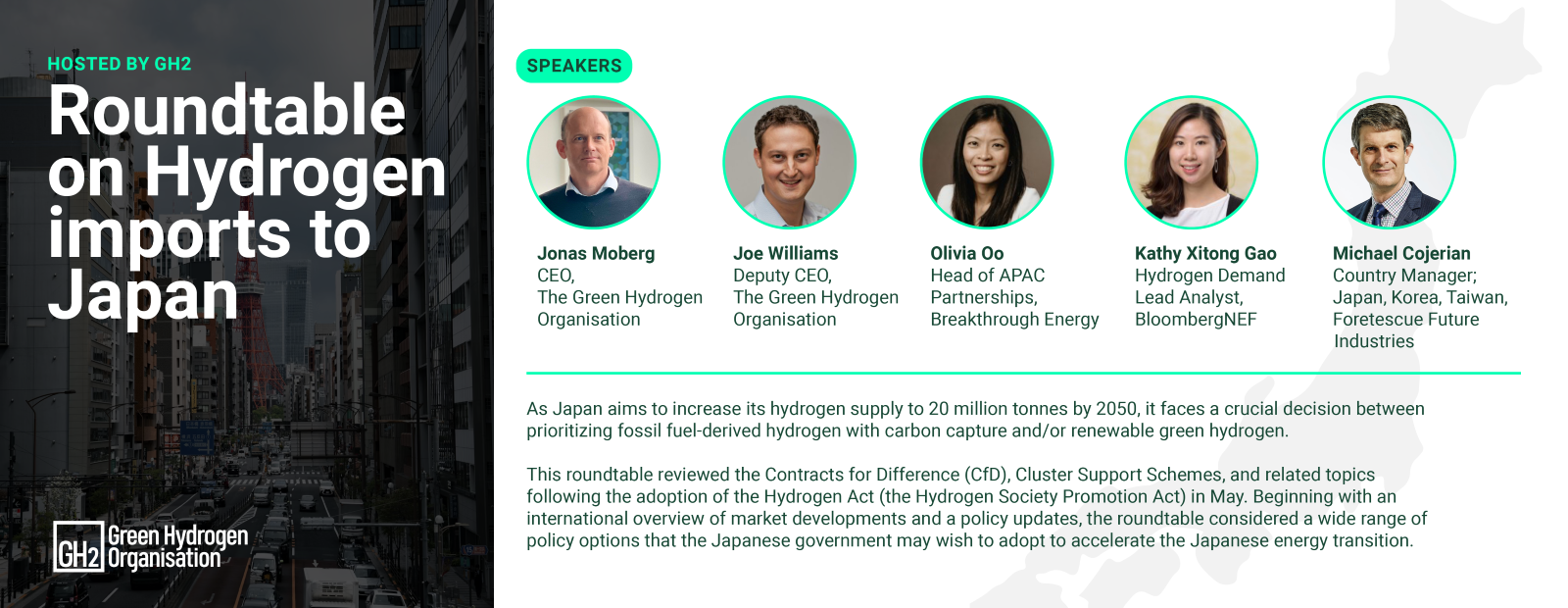

A roundtable in Tokyo and some reality checks on the true emissions intensity of blue hydrogen

At a roundtable in Tokyo this week organised together with Breakthrough Energy as part of the Asia Pacific Green Hydrogen Alliance, we brought together forty participants from industry including banks like Sumitomo Mitsui Trust Bank, green hydrogen producers such as ACME, Adani, Marubeni and Fortescue; and customers like IHI and Mitsui O.S.K Lines. We examined how the country can ensure green hydrogen reaches the country’s shores to help it move away from oil, gas and coal in industry and supplement its relatively low renewable energy capacity with green molecules.

All eyes are on Japan’s Contracts for Difference Scheme and its detailed regulations which are due to be finalised over the next couple of months. A key issue will be the degree to which blue hydrogen made with from fossil gas with carbon capture is able benefit from the USD 19 billion subsidy scheme which will provide 15 years of support for successful projects. We made the case in a separate meeting with officials from Japan’s Ministry of Economy, Trade and Industry (METI) that forms of blue hydrogen which are not truly low carbon risk crowding out green hydrogen and slowing Japan’s decarbonisation journey and will make a submission via a white paper to the government in September.

To demonstrate this point we previewed some new data from a report we will publish next week with the Green Hydrogen Catapult (an initiative established by RMI and the UN High Level Champions) which shows that unless hydrogen import-dependent countries like Japan and South Korea include rigorous site specific measurement of upstream methane emissions and fully include transport and other parts of the hydrogen life-cycle up until the point of consumption, their schemes risk masking between 43-67% of the true emissions associated with blue hydrogen (in this case using an example of exporting blue hydrogen from Australia). In South Korea this issue has led NGOs such as Solutions for Our Climate (SOFC) to challenge the notion that blue hydrogen can be considered ‘clean’ in the country’s constitutional court (which also ruled this week that the country’s climate targets are inadequate to protect citizens).

Both Japan and South Korea appear set to follow the hydrogen emissions measurement methodology currently being drawn up as an ISO Standard which risks lacking a robust approach to measuring upstream methane leakage and strong conditions on carbon storage. GH2 and other organisations continue to engage with the ISO to raise these concerns.

Supporting electrolyser manufacturers

The fraught issue of whether to favour green hydrogen made with Japanese technology such as electrolysers also came up which poses a dilemma given that electrolysers from China can bring the cost of green hydrogen down by two thirds compared to those manufactured in certain OECD countries, as presented by BloombergNEF’s Kathy Xitong Gao during the roundtable. This issue is not restricted to concerns in Tokyo and Seoul, but also in Brussels as many European electrolyser manufacturers argue for support schemes to ensure a level playing field on electrolysers.

Co-firing with coal and natural gas is an issue which is not going away

During our meetings in both Tokyo and Seoul, industry and government made the case for using imported green and truly low carbon hydrogen in the power sector, including through co-firing power plants with green ammonia and coal or natural gas. While green hydrogen is a precious resource and there are more efficient places to deploy green hydrogen – notably in each countries’ sizable steel, shipping and aviation sectors – it is proving an alluring demand sector for international producers from India and elsewhere as Japan and South Korea try to figure out how they can transition away from fossil fuel power generation. Indeed South Korea’s first subsidy auction is focused on hydrogen-fired power generation where it was reported earlier this week that of the 26 companies being considered for a subsidy, 24 of them are set to export to South Korea rather than produce hydrogen domestically (the winners of the auction will be announced in November). What is clear is that where a government is intent on going down this route, it is essential to have a clear end-date, align emissions reductions with national targets and of course use only use the lowest carbon green hydrogen.