Germany

Green hydrogen vision

Germany recognizes green hydrogen as the choice for the future of energy transition and aims to secure its energy supply by ramping up production and mass transport of green hydrogen (National Hydrogen Strategy, 2021). Green hydrogen is expected to substantially decarbonize sectors with some of the largest emissions, including heavy industry and aviation. In addition, Germany is planning to replace fossil fuel in the power generation sector partly through the utilization of green hydrogen. Germany is one of the leading markets for exports and a leader in green hydrogen technology.

Since the country does not have enough renewable energy capacity to produce the fuel in the volumes required, it will need to import green hydrogen in the long run. This will enhance the German energy security regime and create more and more green jobs in the coming decade. Germany is therefore playing a leading role in supporting partner countries with high potential for green hydrogen production through partnerships and investment.

“Our current short-term needs can dovetail with what is already needed long-term for the transformation to succeed. An LNG terminal that today receives gas can tomorrow be used to import green hydrogen” - Olaf Scholz, Chancellor of the Federal Republic of Germany (2022)

National strategy

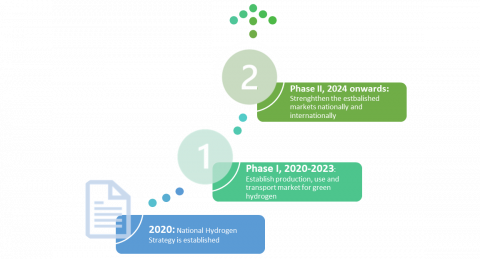

Germany unveiled its hydrogen strategy in mid-2020 during the administration of then-chancellor Angela Merkel. This strategy included a thorough evaluation and potential update after three years. Additionally, the new coalition government, comprising the Social Democrats (SPD), the Green Party, and the Free Democrats (FDP), committed to an “ambitious update” to position the country as a leading player in hydrogen technologies by 2030.

In July 2023, the government revealed a new update. While the original strategy remains fundamentally valid (see below for more on the original plan), the update seeks to accelerate the market ramp-up. It sets forth revised targets and new initiatives.

According to the document, the update "demonstrates how the hydrogen market ramp-up can be accelerated through specific and refined measures to aid Germany’s transition to a climate-neutral economy by 2045." The government emphasised that considering the energy crisis and the conflict in Ukraine, the supply security objective of the 2020 strategy has become even more critical from a security policy viewpoint. This update aims to send an “important industry policy signal” globally, bolstering Germany's business hub position and helping generate sustainable job opportunities.

The government indicated that the strategy will be further updated as necessary.

Capacity targets

Germany has the most ambitious production targets in Europe. The National Hydrogen Strategy has set a green hydrogen production target of 5 GW by 2030, with an additional 5 GW to be built in 2035-2040.

By 2030, the strategy update targets an electrolyser capacity of 10 gigawatts (GW) to generate green hydrogen, positioning Germany as a leading supplier of hydrogen technologies. It anticipates that imports will satisfy 50 to 70 per cent of the nation’s total hydrogen demand by then, increasing this proportion in subsequent years. Consequently, the government planned to introduce an additional Import Strategy for Hydrogen and Hydrogen Derivatives in 2023. It aims to establish 1,800 kilometres of new and refurbished pipelines for a “hydrogen start-up grid” in Germany by 2027/2028.

Impact targets

In the battle against climate change, hydrogen produced from renewable electricity is increasingly viewed as a key solution for sectors with persistent emissions, like heavy industry and aviation. Additionally, it is seen to support the electricity system with hydrogen-powered plants during periods of low renewable generation. Germany aims to position itself as a global leader in hydrogen technologies, having drafted a National Hydrogen Strategy in 2020 to achieve these goals. The current coalition is set to unveil an “ambitious update” to this strategy to make the country a forefront market for hydrogen technologies by 2030.

While the initial strategy “remains valid in principle,” the updated version seeks to accelerate market growth further and introduces revised targets and initiatives. The government points out that, considering the energy crisis and the war in Ukraine, the supply security objectives outlined in the 2020 strategy have gained significance from a security policy standpoint. This update aims to send an “important industry policy signal” globally, reinforcing Germany's position as a hub for business and industry, which will help foster sustainable job creation.

The strategy highlights that enhancing energy efficiency and accelerating the growth of renewable energies are crucial for achieving Germany’s climate targets. It also underscores that direct use of renewable electricity is preferable in many instances, such as electric mobility and heat pumps, due to its lower conversion losses than hydrogen. Although the primary intention is to use hydrogen mainly for specific industrial processes, aviation, shipping, and backup power, other applications are being debated because of more efficient electrical alternatives—like heat pumps and electric cars. The government now states that hydrogen should only be employed in road transport for heavy-duty commercial vehicles and would be utilized in the heating sector in relatively isolated cases.

Policy Spotlight

-

Innovation programme for hydrogen technologies. The Federal Ministry of Transport and Digital Infrastructure (BMVI) has developed an interministerial plan that focuses on continuity for research and development, and addresses the support required for the market activation of first products. The programme (“National Innovation Programme for Fuel Cell and Hydrogen Technology”) supports market activation for products which have reached technical market maturity but are not yet competitive, as a precursor to market ramp-up.

-

Public funding for green hydrogen projects. In January 2022, the German Federal Ministry of Education and Research announced that three hydrogen lead projects will receive a total funding of up to €740 million. The lead projects conduct research in the areas of offshore hydrogen production (H2-Mare), technologies for hydrogen transport (TransHyDE) and the serial development of electrolysers (H2-Giga).

-

Contracts for difference: H2 Global is a 10-year German scheme to support investments in green hydrogen for export to Germany. The intention is to create a double auction system through which hydrogen is purchased in non-EU countries at the lowest possible price with 10-year contracts via a competitive process. The contracts are managed via the intermediary HINT.CO. The first deliveries are planned for 2024.

-

Germany will see hydrogen flow in pipelines in 2025, following the Federal Network Agency's (BNetzA) approval of the hydrogen "core grid". Economy Minister Robert Habeck stated the first pipelines would operate next year, marking a new infrastructure central to the energy transition and establishing Germany as a European pioneer. The core grid will be completed by 2032 at nearly 19 billion euros, comprising 9,040 kilometres of the pipeline—600 kilometres less than initially planned, which Habeck said will reduce grid fees. All federal states will connect to the network, linking hydrogen production, consumption, storage, and import points. Habeck compared the hydrogen grid to the autobahn, emphasizing that primary arteries must be built first, followed by more minor roads to connect companies and power plants.

-

The German government has implemented a strategy for importing hydrogen and its derivatives to enhance the national hydrogen strategy and foster the domestic hydrogen market, as detailed in a press release from the Ministry for Economy and Climate Protection (BMWK). This import strategy outlines a roadmap to satisfy Germany’s anticipated hydrogen demand, estimated to reach between 95 and 130 terawatt hours (TWh) by 2030, with further increases expected in subsequent years. The BMWK projects that approximately 50 to 70 per cent of this anticipated demand will likely need to be met through imports. Furthermore, the strategy highlights a selection of hydrogen derivatives, including ammonia and methanol, and outlines plans to expand the country’s fleet of import ships and pipelines. It also aims to establish agreements with partner nations to promote enhanced regional and international collaboration on hydrogen.

Financing

- The Federal Ministry for Economic Affairs and Climate Action announced €7 billion for the national hydrogen strategy in June 2020.

- €2 billion has been allocated to international partnerships.

- €900 million has been allocated to H2Global.

- Under the National Innovation Programme for Fuel Cell and Hydrogen Technology, the Federal Ministry for Digital and Transport (BMVI) is investing €259 million (for R&D) and €285 (for market activation).

- The German cabinet in 2023 approved an expenditure of €18.6 billion ($20.5 billion) from its Climate and Transformation Fund (KTF) for the hydrogen industry's development over the four-year period from 2024 to 2027. Among this allocation, €3.8 billion is designated for the year 2024.

Government GH Lead

-

Federal Ministry for Economic Affairs and Climate Action (BMWK)

-

Federal Ministry for Economic Cooperation and Development (BMZ)

Comments

There is a strong recognition in Germany that gas needs to quickly be phased out, both for climate and energy security reasons. The government is putting a wide range of ambitious programmes in place to enable a fast transition to be importing and using green hydrogen.