Japan

Green Hydrogen Vision / GH2 カントリーポータル 日本 グリーン水素ビジョン

Japan’s green hydrogen vision is a cornerstone of its strategy to achieve carbon neutrality by 2050. Recognising the challenges of limited domestic fossil fuel resources and the high carbon emissions from traditional energy sources, Japan is investing heavily in hydrogen as a clean alternative. The vision centres around establishing a robust hydrogen supply chain by producing green hydrogen through renewable sources like wind, solar, and hydropower, both within Japan and through international partnerships with countries rich in renewables, such as Australia.

This vision also includes developing infrastructure for large-scale storage, transportation, and distribution of hydrogen across industries. Japan aims to use hydrogen to decarbonize key sectors like transportation, heavy industry, and power generation. The country’s commitment to this vision is evident through substantial government funding and private sector investments in research, development, and the deployment of hydrogen technology that would position Japan as a leader in the global shift toward a low-carbon hydrogen economy.

日本におけるグリーン水素のビジョンは、2050年までにカーボンニュートラルを達成する戦略の要となるものです。化石燃料の限界、大量の二酸化炭素を排出する従来型エネルギー利用のあり方を見直すため、日本はクリーンな代替エネルギーとして水素に多額の投資を行っています。日本国内、オーストラリアのような再生可能エネルギーの豊富な国々との国境を越えたパートナーシップを通じて、風力、太陽光、水力などの再生可能エネルギー源からグリーン水素を生産し、水素サプライチェーンを構築することに重点を置いています。

このビジョンには、業界にわたる水素の大規模な貯蔵、輸送、流通のためのインフラ整備も含まれています。日本は、運輸、重工業、電力などの主要部門の脱炭素化に水素を使用することを目指しています。日本の取り組みとしては、水素技術の研究、開発および展開に対して政府からの多額な資金提供と民間投資が挙げられます。また、日本は低炭素水素経済への世界的な移行においてリーダーと位置付けられています。

National Strategy / 国家戦略

Japan released a revised Hydrogen Basic Strategy in June 2023. Japan was motivated by their 2050 Carbon Neutrality Declaration, made in October 2020 G7 commitments to move away from a reliance on Russian energy, growing calls for climate action, and new hydrogen subsidies under the EU’s Green Deal Industrial Plan and the US’ Inflation Reduction Act.

Japan’s first strategy, released in December 2017, was the world’s first national hydrogen strategy; however, the energy landscape has changed drastically. Japan’s revised strategy intends to generate public and private sector investment in hydrogen over the next decade and increase the use of hydrogen sixfold by 2040. To attract the public and private sectors to GX-related investments, the government plans to contribute upfront investments worth 20 trillion yen and achieve combined investments of 150 trillion yen or more over the next decade.

Japanese government officials highlighted three new features of the refreshed strategy:

-

a new mid-term volume target of 12 million tonnes per annum by 2040 (a sixfold increase from current levels);

-

a “pathway” to low-carbon hydrogen – aiming for 3.4kg of CO2 emissions or less for 1kg of hydrogen produced;

-

a 10% target for Japanese companies’ shares of the global electrolyser market.

To further cement Japan as a ‘hydrogen society’, the “Hydrogen Society Promotion Act” was enacted in May 2024 to codify Japan’s vision and to strongly support the public implementation and utilization of hydrogen.

日本は2023年6月に「水素基本戦略」を改定しました。2020年10月の「2050年カーボンニュートラル宣言」、エネルギーのロシア依存からの脱却(G7のコミットメント)、気候変動対策を求める声の高まり、さらには欧州グリーンディール産業計画および米国インフレ抑制法に基づく水素製造に関する新たな補助金も背景としています。

2017年12月に発表された水素基本戦略は、世界初の国家水素戦略でした。ところが、エネルギー情勢は一変しました。2023年に改定された水素戦略では、今後10年間で水素への官民投資を促し、2040年までに水素の利用を6倍に増やすことを目指しています。政府は官民のGX(グリーントランスフォーメーション)関連投資を引き出すべく、20兆円相当の先行投資を行い、今後10年間で合計150兆円以上の投資を達成する計画です。

日本政府は、新たに3つの目標を強調しました。

-

2040年までに年間1200万トンという新たな中期目標(現在の6倍に増加)

-

低炭素水素への道筋— 水素1kgの生産につき3.4kg以下のCO2排出量を目指すこと

-

水電解装置の市場において日本企業の世界シェア10%を目指すこと

日本を「水素社会」として確固たるものにするため、2024年5月「水素社会推進法」が制定されました。日本のビジョンを体系化し、水素の利活用を促進することを目的としています。

Capacity and Capacity targets / 目標

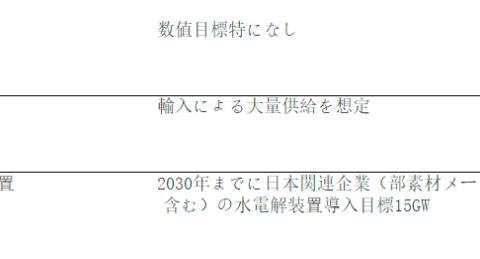

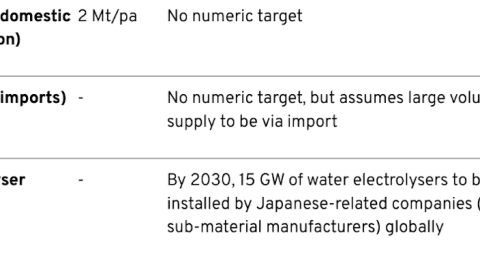

Given below is a comprehensive overview of Japan’s capacity targets as part of its Green Hydrogen Strategy

以下は、グリーン水素戦略の一環として日本が掲げる目標の概要です。

Impact Targets / インパクト目標

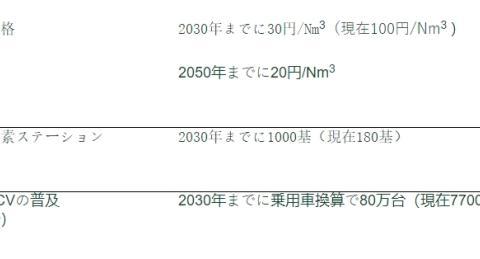

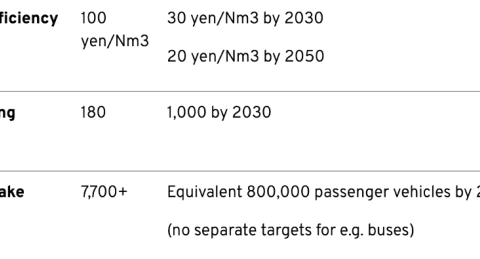

Given below is a comprehensive overview of Japan’s impact targets as part of its Green Hydrogen Strategy

以下は、グリーン水素戦略の一環として日本が掲げる目標の概要です。

Policy Spotlight / 政策のポイント

The Japanese government highlights five key categories (nine areas) as its core strategic focus in the updated strategy. These areas were selected based on two criteria: 1) the market is rapidly growing and sufficiently large, and 2) Japanese companies are believed to have technological advantages in these sectors.

The key areas include:

-

Hydrogen supply (production and construction of the hydrogen supply chain)

-

Decarbonised power generation

-

Fuel cells

-

Direct use of hydrogen (decarbonised steel, decarbonised chemicals, hydrogen-fuelled vessels)

-

Utilisation of hydrogen compounds (fuel ammonia, carbon recycling products)

Japan views Expo 2025 in Osaka as a chance to present its hydrogen technology and share its vision for a hydrogen economy.

The new hydrogen strategy also stipulates that the Japanese government will provide subsidies for establishing the hydrogen supply chain and developing infrastructure based on “carbon intensity.” This means that subsidies will be determined by the level of clean hydrogen emissions rather than the "colour” of hydrogen. The threshold for clean hydrogen is set at 3.4 kg of CO2 emissions per kg of hydrogen on a Well-to-Gate basis. In comparison, the threshold for ammonia is established at 0.84 kilograms of CO2 emissions per kg of ammonia on a Gate-to-Gate basis.

日本政府は最新の戦略において、以下5類型(9分野)を中核となる戦略分野として重点的に取り組むとしています。これらの分野は、1)市場が急速に成長しており、十分な規模があること、2)日本企業がこれらの分野で技術的優位性を持っていると考えられること、という2つの基準に基づいて選択されました。

戦略分野

-

水素供給(水素製造、水素サプライチェーンの構築)

-

脱炭素型発電

-

燃料電池

-

水素の直接利用 (脱炭素型鉄鋼、脱炭素型化学物質、水素燃料船)

-

水素化合物の活用(燃料アンモニア、カーボンリサイクル製品)

日本は、2025年に大阪で開催される万博を水素技術を披露し、水素経済のビジョンを共有するチャンスと捉えています。

また、水素戦略では、日本政府が「炭素集約度」に基づく水素サプライチェーンの構築とインフラ開発に補助金を出すことも規定されています。水素の種類を「色」ではなく、クリーン水素排出量のレベルによって補助金が決定されます。クリーン水素は、Well-to-Gate(原料生産から水素製造まで)ベースで水素1kgあたり3.4kgのCO2排出量に設定されています。それに対し、アンモニアは、Gate-to-Gate(製造工程のみ)ベースでアンモニア1kgあたり0.84kgのCO2排出量に設定されています。

Financing / 資金調達

- The Japan Hydrogen Fund has officially launched, raising $400 million from investors in the banking, hydrocarbons, and automotive sectors. Notable contributors include automotive leader Toyota, oil powerhouse TotalEnergies, hydrogen and industrial gas provider Iwatani, and financial institutions such as MUFG Bank, Sumitomo Mitsui Banking Corporation, the Bank of Fukuoka, Tokyo Century, along with the government-supported Japan Green Investment Corporation for Carbon Neutrality.

- With the enactment of the “Hydrogen Society Promotion Act”, the Japanese government has allocated 3 trillion yen in subsidies (roughly 20 billion USD) through a Contracts for Difference (CfD) system that is designed to incent the adoption and uptake of Japan’s definition of ‘low-carbon’ hydrogen. The support measures are structured around two main pillars: price gap and infrastructure development support, administered through JOGMEC. The price gap support covers the difference between the benchmark price (what suppliers need to charge) and the reference price (what end-users would pay based on alternative fuel costs). The subsidy rate is 100% of eligible expenses, with specific caps to ensure budget control. To access the price gap support, projects must supply at least 1,000 tons of hydrogen equivalent annually and focus on hard-to-decarbonize sectors. Infrastructure development support has a higher threshold of 10,000 tons annually and requires clear regional economic benefits. These projects must demonstrate shared infrastructure potential for multiple users and have strong community support.

-

水素特化型ファンド「Japan Hydrogen Fund」が正式に発足し、銀行、炭化水素、自動車部門から4億ドルを調達しました。主な出資者には、自動車大手のトヨタ、石油大手のトタルエナジーズ、水素および産業ガス製造販売の岩谷産業、三菱UFJ銀行、三井住友銀行、福岡銀行、東京センチュリーなどの金融機関、および政府支援の脱炭素化支援機構(JICN)などがあります。

-

水素社会推進法の制定に伴い、日本政府は、差金決済契約(CfD)制度を通じて3兆円(約200億ドル)の補助金を割り当てました。CfDは日本の低炭素水素の定義と普及促進のために導入されました。支援策は、独立行政法人エネルギー・金属鉱物資源機構(JOGMEC)を通じて「価格差支援」と「拠点整備支援」という2つの柱を中心に構成されています。価格差支援は、基準価格(サプライヤーが請求すべき価格)と参照価格(代替燃料コストに基づいてエンドユーザーが支払う価格)の差額をカバーします。補助率は対象経費の100%で、予算確保のために上限額が設定されています。価格差支援を受けるには、少なくとも年間1000トンの水素を供給し、脱炭素化が難しい分野に焦点を当てている必要があります。拠点整備支援の基準は年間1万トンと高く、経済利益が必要です。これらのプロジェクトには、複数のユーザーが共有できる拠点を示し、強力なコミュニティサポートを行う必要があります。

Government green hydrogen lead / グリーン水素主導機関

Ministerial Council on Renewable Energy, Hydrogen and Related Issues

Ministry of Economy, Trade and Industry (METI)

Japan Organization for Metals and Energy Security (JOGMEC)

Agency for Natural Resources and Energy (ANRE)

再生可能エネルギー・水素等関係閣僚会議

経済産業省(METI)

独立行政法人エネルギー・金属鉱物資源機構(JOGMEC)

資源エネルギー庁(ANRE)